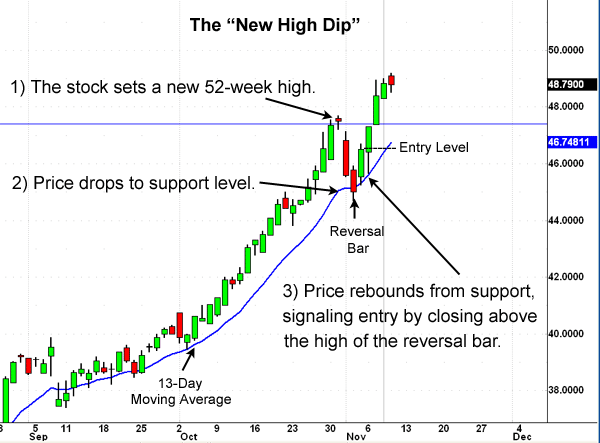

Powerful yet easy to understand, the New-High-Dip consists of buying the first pullback or “dip” after a stock makes a new high. What makes this setup work so well is the consistency of human nature, which is the driving force behind all market behavior.

The New-High-Dip gives safe entry into stocks that are trading higher

Here’s how it works. After the initial flurry of buying that occurs when a stock breaks out to a new high, prices will usually pull back for a short breather. This retreat is almost always a buy and provides a safe entry on a stock that has obviously shown strength already.

Emotional dynamics support this stock trading tactic. One group of traders missed the first breakout and are hoping for another chance to get in before prices race off to even more new highs. They buy into the pullback and in doing so contribute their part to slowing the decline with their cash investment. They feel a sense of relief that they’ve made a wise choice and patiently wait for the shares to bounce.

Another group is already in the stock with profits, having bought into the stock before the breakout. They are looking for a chance to add to their positions and will take advantage of the retreat to get in at a good price.

The last gang of traders are the guys and gals who, just like the second group, bought into the stock before the breakout. But instead of holding on as prices began to retreat, they sold near the high and pocketed some profits for their efforts. Now they are watching the pullback and waiting for a rebound to get underway to they can buy some more shares and ride the “profit highway” once again.

Stock trading online. Online trading Reports for successful stock market trading online.

Each of these groups of buyers will help the stock find a new support level and resume the advance to new highs again. However, there are a few things that can interrupt the stock’s upward progress. If the overall market falls hard enough and long enough, trader’s moods can change and more selling will occur, stopping the stock from rebounding. Negative news about the company or industry can also have an impact and keep the stock from heading higher.

To protect your trading account, always use sell stops to prevent major losses. Remember that no tactic will work 100-percent of the time, but sound risk management will ensure that any potential losses are minimal.

Just make sure that the reason for the stock’s decline is due to normal profit taking and not some outside event.

Knowing the proper time to enter is very important. Usually a support zone provided by a moving average, trend line, or other technical support will provide the initial reversal setup. Knowing exactly when to pull the trigger only comes with practice and experience. The RightLine Report gives you an advantage by providing New-High-Dip trades along with specific entry, exit, and stop-loss levels for each one.