The “Gap Adjusted Entry” is a technique we use to reset our entries when a stock gaps open beyond or through the recommended RightLine Report entry price. For those who aren’t familiar with the term, a “gap open” is simply the difference between the price of a stock at the open compared to the previous day’s close – either up or down. For a more details be sure to read this related article on the Gap Open Trading Tactic.

Here’s how the Gap Adjusted Entry works.

Let’s say that a stock closes at $30, and we plan to buy it IF it reaches $32. However, the next morning it gaps higher – beyond our entry price of $32, and opens at $33. We can then apply the gap open tactic. Instead of entering immediately at $33, we wait until the stock has traded for thirty minutes. We then check the highest price that the stock traded at during that thirty minutes, and re-set our entry point to just above that level.

How Much to Adjust

The amount to adjust the entry is usually 0.25 for stocks priced up to $50, 0.50 for stocks from $50.01 to $100, and 1.00 for stocks over $100. Once the price is reached, we enter our trade. It’s as simple as that. If the stock has “real” buying behind it, prices will first gap up at the open, dip down as day-traders grab a quick profit, then turn around and move higher. By waiting until the first thirty minutes of trading is past, we avoid buying at what is very often the high of the day.

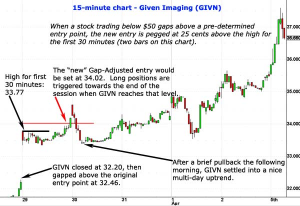

Example of a Buy Entry – (Long)

Take a look at the example below. The original entry price is set at $32.46. On March 28 GIVN closes at $32.20 – beneath the planned entry level. The next morning GIVN gaps open above the planned entry level. This is where the Gap Adjusted Entry technique comes in. The high for the first 30 minutes of trading on March 29 is $33.77, so the original planned entry is adjusted to just above that level. The new Gap Adjusted Entry is set at 34.02. Later in the session price moves up to the new entry level, triggering the trade.

A Common Misinterpretation

On several occasions we’ve received feedback from traders who have applied the Gap Open Tactic incorrectly. To help clarify what NOT to do, let’s review a common error.

Here’s the mistake. Buyers noted the high of the first 30 minutes and then immediately placed a bid to buy at 1/4 point higher then the high of the day – even though the stock had dropped and was currently trading much lower. See the problem? This meant that their open order was filled immediately at the higher price, WAY over the current bid and ask price. You can bet that some seller was very pleased!

There is an easy way to avoid this – just wait to see if the stock continues to go higher BEFORE placing the order. If you are unable to wait for the market to move higher, just enter a “buy stop order” using the Gap Adjusted Entry price. A “buy stop order” is held by your broker until the stock price rises to your specified stop price, at which point it is executed at the market price.

Gap Adjusted Entries for Shorting

For traders who like to sell short, the Gap Open Tactic can also be used effectively when stocks gap lower. Simply wait 30-minutes, then adjust the entry level to just BELOW the suggested short entry price. Subtract the same adjustment amount that we used with long positions – 0.25 for stocks priced up to $50, 0.50 for stocks from $50.01 to $100, and 1.00 for stocks over $100.

Example of a Short Sale Entry – (Short)

Take a look at the chart of IGT below. In this example the original entry price – a short – is set at $46.14. On April 21 IGT closes at $46.57 – beneath the planned entry level. The next morning IGT gaps open below the planned entry level. This is where the Gap Adjusted Entry technique comes in. The low for the first 30 minutes of trading on April 22 is 44.09, so the original planned entry is adjusted to just beneath that level. The new Gap Adjusted Entry is set at $43.84. Later in the session price moves down to the new short entry level, triggering the trade.

RightLine traders have found that the Gap Adjusted Entry method helps avoid being “top Picked” on long entries – buying into a reversal near the session high. It also reduces the likelihood of being “bottom picked” when going short. Like any system, method, tactic or strategy, the Gap Adjusted Entry doesn’t work all of the time. However, it does offer traders and investors an intelligent alternative when your original entry is lost in the gap.