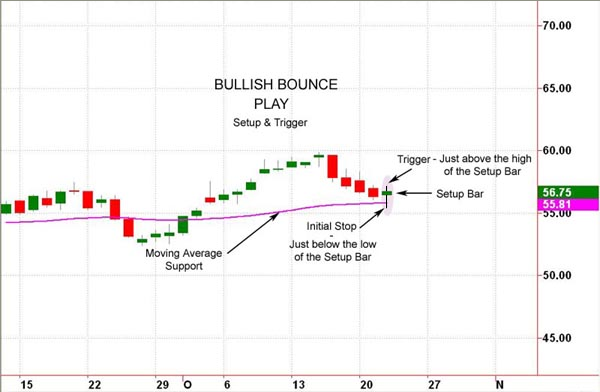

The “Bullish Bounce”

With this trading Set-up, we first look at the current trend that the stock is in. As the name implies, the trend has to be bullish. In other words, the trendline or moving average has to be rising upward. Once the price action rises above the trendline or moving average, we will watch the stock and wait for a pullback to take place. A pullback occurs when the stock price declines enough to make contact with the line.

An important requirement for a Bullish Bounce set-up is determined by how the stock price reacts when it comes in contact with the line, which is called a “support level.” The preferred reaction occurs whenever price dips to the support level during intra-day trading, then reverses and moves up a certain percentage of the day’s high-to-low range.

Once the Bullish Bounce Setup is in place, we want to see a confirming sign that the previous upward trend is about to resume. This is usually a price move above a short-term technical resistance level, such as the high of the Set-up day, and should normally occur within one or two days after the Set-up day. That move is our signal to immediately enter the stock. Once a position is bought, we always place an Initial Stop for protection, and then follow up with a Trailing Stop as the trade moves favorably.

Here is an example of a Bullish Bounce Play setup:

A positive aspect of The Bullish Bounce is the tendency for the stock price to gain momentum as it moves away from the point of entry. These trades often become positive very quickly, allowing the initial stop to be moved to the break-even level. At this point the position essentially becomes a “free” trade with no risk of loss – as long as the stop is only moved in the direction of the profit.